COVID-19 FAQ

A guide to today’s mobile consumption trends, news, and best practices.

Updated: Monday, May 18, 2020

We hope that you and your loved ones are safe as we navigate through this unprecedented period. Kargo has taken significant measures to ensure the well-being and safety of our employees as we have virtualized all of our operations in alignment with government recommendations. Our team is well situated with tools and infrastructure to ensure our daily operations are uninterrupted as we continue to meet our clients’ needs. As always, we are here to help.

This FAQ page serves as a curated hub for mobile trends, best practices & additional resources as we all strive to understand digital marketing in this new world.

Jump to categories:

Industry Trends

+ What brand/advertiser changes/trends have been revealed due to COVID-19 and social distancing?

- According to AdExchanger, smartphone usage has increased from 2.5 hours per day to almost 4 hours in mobile web and app.

- News publishers’ traffic has increased by 60%, but brands are avoiding COVID-19 content. The revenue impact could compromise the ability of new publishers to provide facts, resources, and information that contribute to public well-being.

- With many industry events and conferences getting cancelled, organizers are opting to go virtual.

- According to eMarketer, 9 out of 10 older consumers are more likely to avoid going into stores during this pandemic, compared to 75% of all shoppers.

- With fewer shoppers opting to go into grocery stores, there has been a 67% increase in online shopping orders from Amazon, Instacart, Kroger, Shipt, and Walmart according to eMeals.

- While content analytics platform Parse.ly forecasted the Democratic Primary would eclipse news coverage in March, COVID-19 coverage is nearly 20X more than the Democratic Presidential Primary.

- Certain verticals are doubling down on their marketing efforts as people’s daily routines have shifted. These verticals include:

- Entertainment & streaming services

- Internet providers

- Gaming companies

- Wireless carriers

- Business/WFH solutions

- Corporate responsibility & how companies are giving back during the pandemic

+ How have consumer shopping trends shifted (by category) with the impact of COVID-19?

Source: Placed

Date range: week ending February 19 - week ending March 20, 2020

- Apparel: Consumers aren’t shopping for clothes in-store -- foot traffic to clothing stores is down 41% nationally, while visits to malls overall are down 36%

- Alcohol: Consumers are drinking at home -- while visits to bars are down 30% nationally, foot traffic to liquor stores is up 25% and foot traffic to grocery stores is up 34%

- CPG/Grocery/Warehouse/Convenience/Gas/Drug: Consumers are stocking up -- visits to grocery stores are up 34%, to warehouse stores are up 28%, to drug stores are up 21%, to convenience stores are up 5%, and to gas stations are up 3%

- QSR: After an initial uptick, visits to QSRs are down 11%

- Casual Dining: Consumers are avoiding restaurants -- foot traffic to casual dining chains are down 47% nationally

- Financial Services: Consumers are taking action to prepare financially -- banks saw a nearly 20% uptick on March 5, but foot traffic has since returned to ‘normal levels’ (up 2% nationally)

- Hardware: Consumers are stocking up -- visits to hardware stores are up 26% nationally

- Travel: Consumers are cancelling travel plans -- visits to airports and hotels are both down 40% nationally

+ Digital Media Behavior by Vertical

Percent Change in Total Digital Visits to Key Content(?) Categories

Comscore, Total Visits, Desktop and Mobile (Web and Apps). US Only. March 16-22 vs February 17-23), 2020

- Family + Youth Education Category: +115%

- Government Category: +299%

- News Category: +45%

- Retail Category: +11%

- Social Media: +16%

- Travel Category: -34%

- Financial Category: -2%

+ How has COVID-19 affected mobile usage trends?

In 2020, we anticipate a 13.9% YOY increase in average time spent on smartphones among the US population. eMarketer, April 2020. Age 18+; includes all time spent with nonvoice activities of smartphones

45% of US internet users are spending more time on smartphones since the Coronavirus pandemic, the largest share of any other platform. GlobalWebIndex, Device US Internet Users Have Been Spending More Time Using Since the Coronavirus Pandemic, March 2020. “Coronavirus Research: Multi-Market Research Wave 3.” April 29, 2020

Kargo Trends

+ How has COVID-19 related content performed over time?

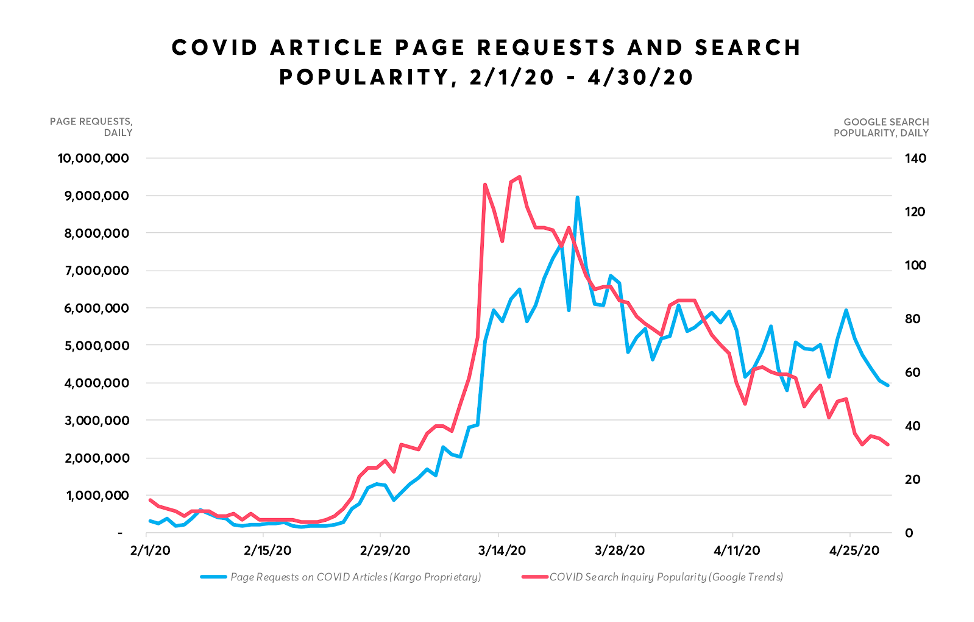

- Kargo saw a significant spike in traffic surrounding coronavirus-related content during the first half of March 2020, with a gradual decrease in traffic through April. Google search inquiries have also showcased similar trends, indicating that the peak of interest in coronavirus content is waning and users have moved on to consuming non-COVID content as t time spent online continues to grow.

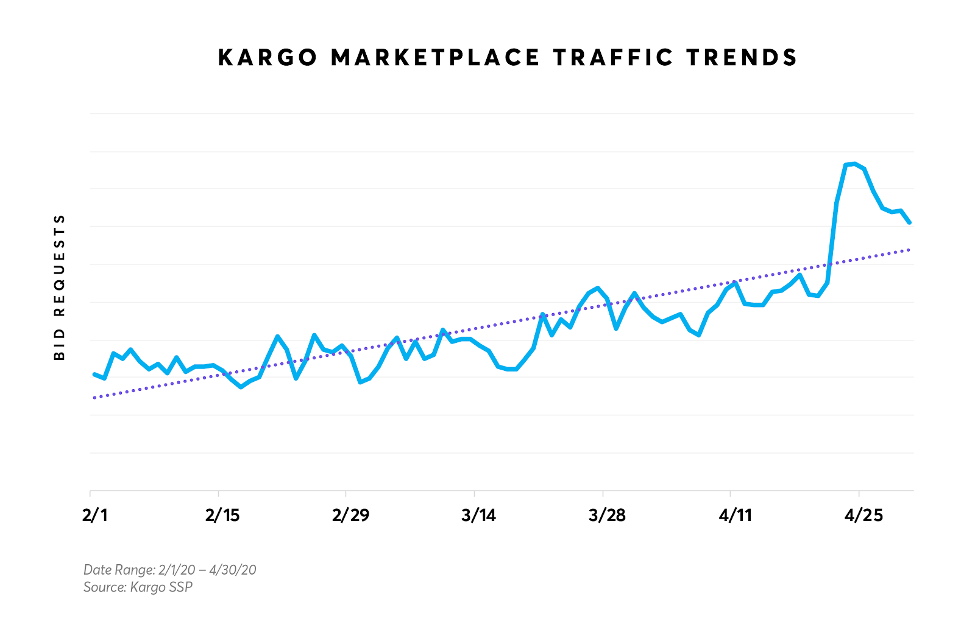

- Kargo has seen an increase in traffic across all marketplace publishers. Despite Covid-related content consumption having decreased through April, Kargo has seen a 40.27% increase in overall bid requests in April vs March.

+ Did Kargo seen any changes in traffic due to the initial onset of COVID-19?

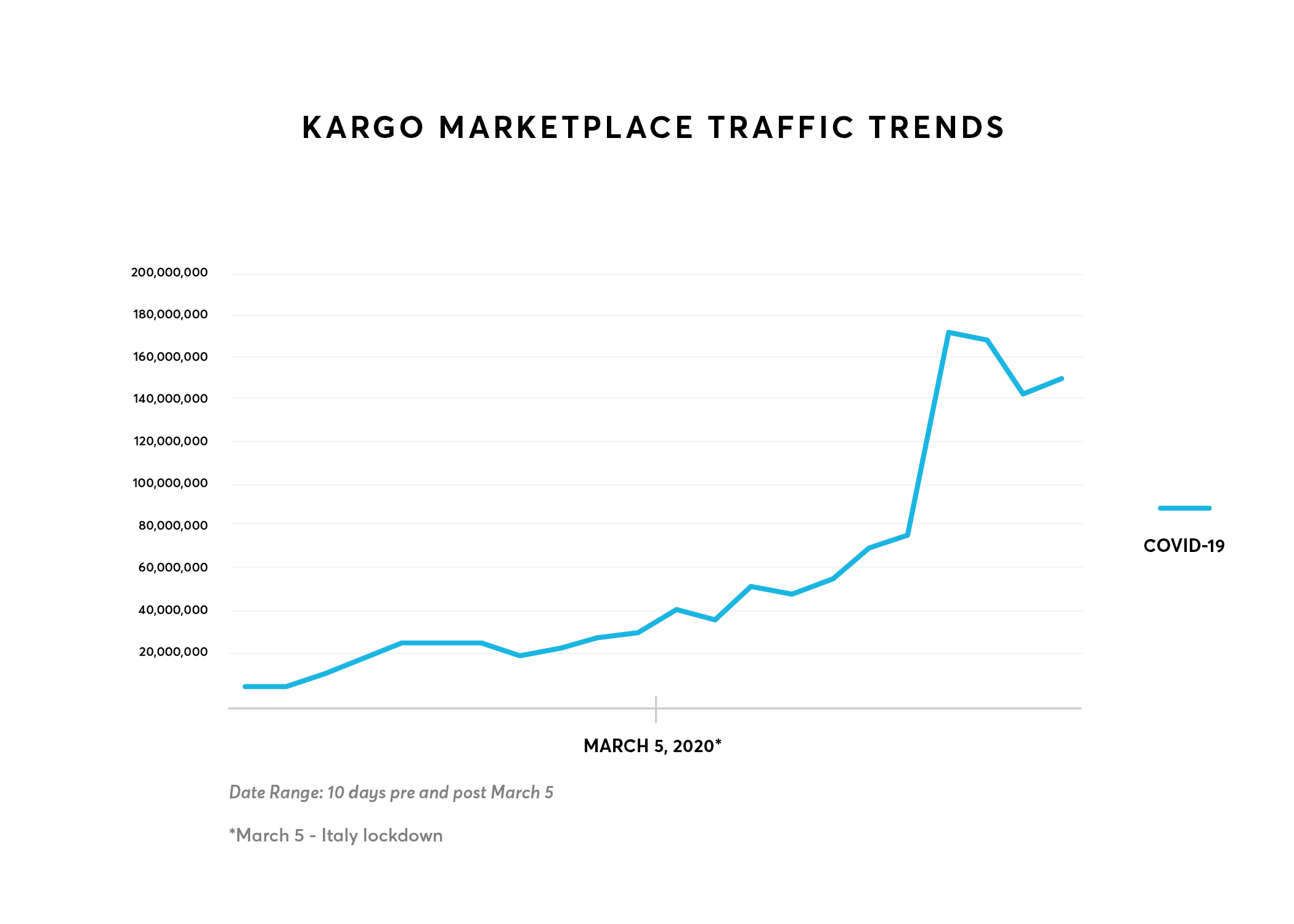

- Yes, Kargo has seen a 24% increase in mobile web traffic week over week. While our non-COVID-19 traffic has remained flat, the influx has been driven by incremental readership of coronavirus content.

+ Has ad performance across Kargo been impacted by COVID-19?

- Social distancing undoubtedly is impacting consumers mobile consumption habits. Kargo has seen a 15% increase in overall ad engagement (with a 45% increase in engagement across COVID-related content) between 2/20 and 3/20.

- Ad Performance by Vertical:

- CPG: 20% increase in overall ad engagement

- 40% increase in overall ad engagement across COVID-related content

- Alcohol: 20% increase in overall ad engagement

- Finance: 40% increase in overall ad engagement

- Retail: 25% increase in overall ad engagement for department/big box retailers

- 40% increase in overall ad engagement across COVID-related content

- Telecom: 25% increase in overall ad engagement across COVID-related content

- CPG: 20% increase in overall ad engagement

- Top Performing Ad Formats:

- In-Article (300x250 Middle Banner, Venti, HighRise): 47% increase in overall CTR

- Adhesion (Anchor, Breakout,Hover): 70% increase overall CTR

(data range: 2/20 vs 3/20)

+ What content categories, topics, and keywords outside of COVID-19 content are trending within your platform?

- IAB Content Categories:

- Hobbies & Interest

- News

- Style + Fashion

- Topics:

- Continuing Education: As the economy continues to fluctuate and potential unemployment is top of mind, many people are researching coding classes, computer certifications, computer science, and getting published.

- Family & Parenting: With many schools shut down and parents homeschooling their children key topics include: teaching, classroom resources, coursework and, & study tips.

- Keywords:

- Politics: 2020 Democratic Primaries, Townhall

- Entertainment & Sports: Netflix & Streaming, XBOX Live, Gaming, Disney+, Star Wars, PS5, Tom Brady

- WFH: Google Hangouts/Microsoft Teams/Zoom/Computer Equipment

- Business: Dow Futures/Stimulus Check/Federal Reserve

- Environment: Venice Canals, Pollution Eased

- Education: Scholastic/ Learn at home

+ What types of article sentiments are trending?

.png)

+ Are there positive COVID-19 articles?

- In times of great adversity, the world has a way of coming together. Whether it’s a neighbor grabbing groceries, retired doctors and nurses reporting for duty, or entertainment companies releasing anticipated content early, there are positive and uplifting stories in difficult times. See below for positive articles.

+ What are the definitions of the sentiment categories?

- Pure Positivity: Fun Reads

- Inspirational: Encouraging Stories

- Nostalgia: Remembrance

- Informative: Neutral Journalism

- Curious/Inquisitive: Pop Culture & Celebrity Lifestyle

- Anxious: Financial Guidance or Health Advice

- Suspenseful: Investigations & Mysteries

- Provocative: Opinionated

+ How does sentiment targeting work?

- Kargo leverages IBM's natural language decisioning platform and our proprietary internal machine learning algorithms to extract and analyze the content of an article and provide a composite emotional score, which classifies the article into composite emotions such as: Inspirational, Nostalgia, Anxious, Curiosity, and more. Our decisioning engine then finds ad calls that fit the classification of the segment and then can decide to deliver impressions or not, based on the emotional score and campaign targeting criteria.

+ How can I utilize sentiment targeting during these uncertain times?

- Kargo can leverage this technology to identify and avoid content that is classified to have Anxious and other Negative sentiments, while maintaining scale and reach across our entire marketplace of premium publishers. We can layer this sentiment data with additional contextual signals at the article level, including site and keyword lists, to develop a highly customized targeting strategy.

How Kargo is helping

+ How is Kargo preventing the spread of mis-information around COVID-19?

- Kargo is as committed to media quality and brand safety as ever. Core to our mission is supporting high quality professional journalism. Accurate and reliable information is essential to encourage responsible decision making and promote stability in our communities. We’ve curated an invite-only marketplace with 100 of the world’s most premium publishers including NBC, CBSi, Buzzfeed, Penske Media, and Discovery. Each of our publishing partners have a dedicated writing and editorial team to ensure only factual information is added to their sites. We do not partner with any “user-generated’ content sites. To ensure our standards are consistently met, our publisher partnership team deploys a monthly pub scorecard inclusive of editorial quality, scale, viewability, brand safety, match and response rates. Our publishing partners must maintain a passing grade in order to remain a part of our marketplace.

- Kargo white-lists all of our advertisers’ domains on our platform. We scan creatives and if advertisers do not meet our community standard guidelines, they will be blocked from advertising within our marketplace.

+ What steps is Kargo taking to ensure brand safety for my media campaign?

- Given the current situation, we know brand safety is a primary concern. At Kargo we have enhanced our proprietary technologies to guarantee brand safety for advertisers:

- Update Keyword Targeting to Exclude COVID-19 Content - Through our trusted partnership with Oracle Contextual (formerly Grapeshot), we have the ability to add COVID-19 / coronavirus related topics to all negative keyword and content exclusion lists.

- Revise Contextual Strategy - Site lists can be revised to remove certain topics or to emphasize specific verticals such as lifestyle, food, entertainment, or sports.

- Reduce Ad Exposure on Anxious Content with Sentiment Targeting - We can exclude any “anxiously-charged” content using Kargo's proprietary sentiment targeting capabilities.

- In an effort to support our publisher community, which relies on ad revenue to deliver free digital press, we are asking brands to revisit their media strategies and include news publications that provide information and resources in the public interest.

+ How is Kargo helping support communities during this trying time?

- Kargo’s commitment to quality journalism and brand safety is as strong as ever. These concepts are core to Kargo’s mission as we continue to support both our publisher and marketing partners. Now, more than ever, accurate and reliable information is essential to promote responsible decision making, safety and stability. We stand with our publishers.

- Kargo has been, and will continue to, accept pro bono campaigns to spread awareness for community and relief organizations. As our partners create COVID-19 resources for the public, we want to work with them to drive traffic and share knowledge. If you are interested in partnering with us, please contact us here.